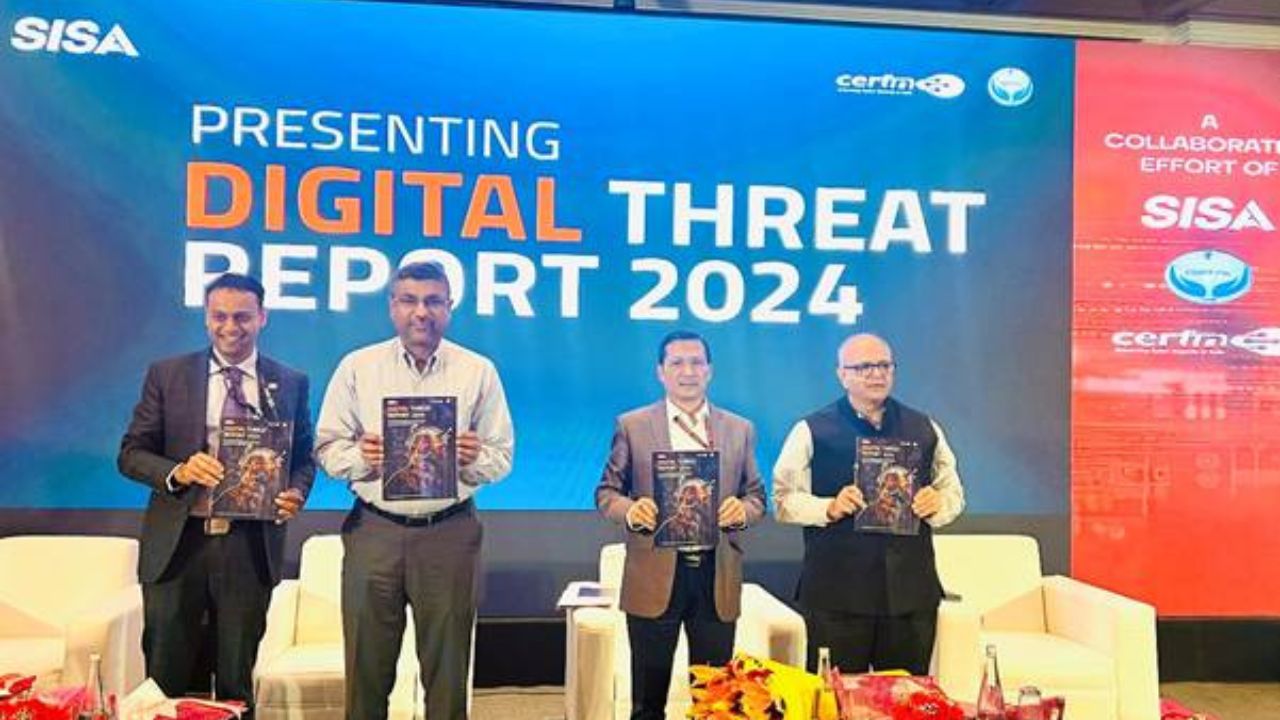

The Indian Computer Emergency Response Team (CERT-In) has teamed up with CSIRT-Fin and global cybersecurity firm SISA to create the Digital Threat Report 2024, aiming to improve cybersecurity in the Banking, Financial Services, and Insurance (BFSI) sector. This comprehensive report offers an in-depth analysis of current and emerging cyber threats, along with strategic defence mechanisms tailored for the BFSI sector.

Emphasising Unified Cybersecurity Measures

At the report's launch, S. Krishnan, Secretary of MeitY, underscored the critical need for a unified cybersecurity framework to safeguard India's financial infrastructure. He highlighted that the interconnected nature of the BFSI ecosystem means a single cyberattack could have widespread repercussions, affecting multiple entities beyond the initial target. This situation underscores the urgent need for coordinated cybersecurity efforts at both national and sectoral levels.

Krishnan emphasised the vital roles of CERT-In and CSIRT-Fin in mitigating these risks through collaboration with regulators, industry stakeholders, and global cybersecurity bodies to ensure timely detection, response, and recovery from cyber incidents. He expressed confidence that the report, developed in partnership with SISA, would empower BFSI organisations to enhance their defences, minimise financial stability risks, and build a collective cybersecurity strategy to effectively counter sophisticated cyberattacks.

Read the latest news on AI here!

Cybersecurity: A Pillar of Financial Stability

M. Nagaraju, Secretary of the Department of Financial Services, Ministry of Finance, Govt of India, highlighted the profound implications of cybersecurity on economic stability and public trust. He stated that cybersecurity is no longer an optional safeguard but the foundation of financial stability in the digital age. As India's BFSI sector rapidly expands, securing digital transactions becomes not just a regulatory necessity but an economic imperative.

Nagaraju emphasised that the Digital Threat Report 2024 for BFSI, produced through a collaboration of national cybersecurity agencies and industry leaders, underscores the necessity of an integrated approach that merges technology, regulatory compliance, and proactive threat intelligence. He believes the report serves as a strategic blueprint, equipping financial institutions with the intelligence needed to anticipate vulnerabilities, strengthen defences, and build cyber resilience in an era of increasingly sophisticated threats.

Insights into the Cybersecurity Landscape

The Digital Threat Report 2024 offers a holistic analysis of the cybersecurity landscape affecting the BFSI sector. The collaborative nature of this initiative, which brings together frontline cybersecurity providers, national agencies, and financial sector incident response teams, highlights the urgent need for a proactive, intelligence-driven approach to mitigate digital risks. The BFSI sector is at the heart of global digital transformation, with digital payments projected to generate $3.1 trillion by 2028, accounting for 35 per cent of total banking revenues.

However, the rapid shift to digital transactions has also expanded the attack surface for cybercriminals. The 2024 Digital Threat Report stands apart by examining current threats and emerging vulnerabilities and offering a deep dive into adversarial tactics that impact system-level operations. It provides a unique perspective on sector-wide security gaps while delivering a forward-looking analysis of anticipated cyber risks, equipping financial institutions with the insights needed to prepare for both today's and tomorrow's cyber threats. Dr Sanjay Bahl, Director General of CERT-In, emphasised that the report is designed to empower financial institutions to stay ahead of adversaries, adapt to emerging risks, and build long-term cyber resilience.